As millions of more Americans filed for unemployment benefits last week, the United States hits depression era rates that go back to the times of the Great Depression, as back as in the 1930’s. This is but one of the many effects the coronavirus crisis continued to have on the US and world economy.

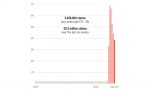

First-time claims for unemployment benefits totaled 3.8 million in the week ending April 25, after factoring in seasonal adjustments, the US Department of Labor said.

Without those adjustments — which economists use to account for seasonal hiring fluctuations — the raw number was 3.5 million.

That brings the total number of first-time claims to 30.3 million over the past six weeks — representing roughly 18.6% of the US labor force — as businesses have laid off and furloughed workers during stay-at-home orders across the country.

After peaking at 6.9 million in the last week of March, claims have fallen each of the last four weeks — an encouraging sign that at least things aren’t getting worse.

But overall, joblessness remains a dire problem. Friday marks May 1, and for millions of Americans, rents and mortgage payments will be due. Unemployment benefits are one of the key forms of financial aid that are helping families plug the gap.

“A number in the low millions may be a relief compared to earlier this month, but it’s objectively a horrifying statistic,” said Nick Bunker, director of economic research at the Indeed Hiring Lab.

Rising joblessness will weigh on incomes and consumer spending, which is the largest contributor to the economy. Personal incomes fell 2%, and personal consumption expenditures dropped 7.5% in March, according to the Commerce Department.

And it’s uncertain how many more people will lose their jobs in the weeks to come. Although businesses like retailers, hotels and restaurants were among the first to lay off and furlough workers early in the pandemic, economists predict layoffs will start to impact white-collar jobs, too. Meanwhile, a rout in the oil market is expected to lead to bankruptcies in the sector, making job losses worse in the energy industry. One big question now is whether initial claims will peak above or below 40 million in this crisis, said Joe Brusuelas, chief economist at RSM US.

As part of a $2 trillion CARES Act package signed last month, Congress expanded unemployment benefits to include an extra $600 per week on top of state benefits, for up to four months. They also expanded the eligibility requirements to include independent contractors, gig workers and self-employed workers.

Not all claims result in paid benefits.

Continued jobless claims, representing workers who filed for their second week of benefits or more, stood at nearly 18 million in the week ended April 25, after seasonal adjustments, up from 15.8 million in the prior week, the Department of Labor said.

Many claimants have faced delays in receiving their benefits, as state labor agencies have scrambled to update their intake systems in response to guidance from the Department of Labor. President Trump signed the CARES Act on March 27, and according to a statement from the Department of Labor released on Wednesday, it took until April 28 for all 50 states to get the emergency payments up and running.

So far, Hawaii, Kentucky and Georgia have seen the largest percentages of their labor forces file for first-time jobless benefits. About 29% of workers in Hawaii have filed first-time unemployment claims since March 14, as its tourism industry has come to a standstill.

Looking ahead to a historically weak jobs report

Next week, the US Bureau of Labor Statistics will release its official jobs report for April.

That report is expected to show the US unemployment rate surged to 14% in April. That would be the highest since the monthly data series began in 1948. During the Great Depression, annual estimates show the unemployment rate peaked at 24.9% in 1933.

The nation’s official unemployment rate is estimated from a survey of about 60,000 households — not the number of unemployment claims. To be counted as “unemployed” in that report, survey respondents need to have been out of work but available to work, and actively searched for a job in the prior four weeks.

It will take time for America’s labor market to bounce back from the pandemic. On Wednesday, Federal Reserve Chairman Jerome Powell said it would be a while until February’s historically low unemployment rate of 3.5% would be achieved again.

How high the jobless rate will go and how long it will take to come down again will depend on the shape and pace of the economic recovery.