Surprise!!! Wait for it… Ouch, refunds are not looking good. Many are flocking to get their tax returns filed especially under the threat of another possible government shutdown. Typically the ones that do their taxes early are those low and middle income individuals and families that depend on the tax season to lower their debts, or cover for expenses they can’t afford throughout the year as simple as buying new clothes or as extravagant as a family vacation.

While at face value statistics show much less returns have been filed so far, this could be do to various reasons. One of those reasons is that people are still trying to wrap their heads around the fact that they’re awaited refunds are much slimmer and in some cases they’re owing money to IRS for the first time, causing many to second guess their beloved accountants and search for second opinions.

To sum it up, these are the main reasons many are seeing lower returns and in some cases owing money instead:

1. The main reason is that the standard deduction is a lot higher with the tax reform making it much more difficult for average people to go over and get a return higher than the standard.

The standard deduction is about doubled from 2017. For filers filing single it is $12,000 from $6,350, Married filing jointly (or qualified widow(er)) it’s $24,000 from $12,700, married filing separately it’s $12,000 from $6,350, head of household it’s $18,000 from $9,350.

2. If you think the standard deduction is difficult to reach and surpass before you can see an extra dollar in your favor, now itemized deductions have been limited and don’t even apply for many income earners.

3. Another significant hit which affects homeowners and middle class income earners is that taxpayer’s deduction for state and local income, sales and property taxes is limited to a combined, total deduction. The limit is $10,000 – $5,000 if married filing separately. Anything above this amount is not deductible.

4. The date a taxpayer took out their mortgage or home equity loan may also impact the amount of interest they can deduct. If a taxpayer’s loan was originated or was treated as originating on or before Dec. 15, 2017, they may deduct interest on up to $1 million in qualifying debt, or $500,000 for taxpayers who are married filing separately, If the loan originated after that date, the taxpayer may only deduct interest on up to $750,000 in qualifying debt, or $375,000 for taxpayers who are married filing separately. The limits apply to the combined amount of loans used to buy, build or substantially improve the taxpayer’s main home and second home.

5. Interest paid on most home equity loans is not deductible unless the interest is paid on loan proceeds used to buy, build or substantially improve a main home or second home.

For example, interest on a home equity loan used to build an addition to an existing home is typically deductible, while interest on the same loan used to pay personal living expenses, such as credit card debts, is not.

As under prior law, the loan must be secured by the taxpayer’s main home or second home (known as a qualified residence), not exceed the cost of the home and meet other requirements.

6. Now there’s a limit to what can be deducted for casualty and theft loss. A taxpayer’s net personal casualty and theft losses must now be attributable to a federally declared disaster to be deductible.

7. Good bye to miscellaneous itemized. Previously, when a taxpayer itemized, they could deduct the amount of their miscellaneous itemized deductions that exceeded 2 percent of their adjusted gross income. These expenses are no longer deductible.

This includes unreimbursed employee expenses such as uniforms, union dues and the deduction for business-related meals, entertainment and travel. It also includes deductions for tax preparation fees and investment expenses, such as investment management fees, safe deposit box fees and investment expenses from pass-through entities.

On the flip side to all this doom and gloom you’ll be happy to know that if you are a charitable person. The limit on the deduction for charitable contributions of cash has increased from 50 percent to 60 percent of a taxpayer’s adjusted gross income. This means that some taxpayers who make large donations to charity may be able to deduct more of what they give this year.

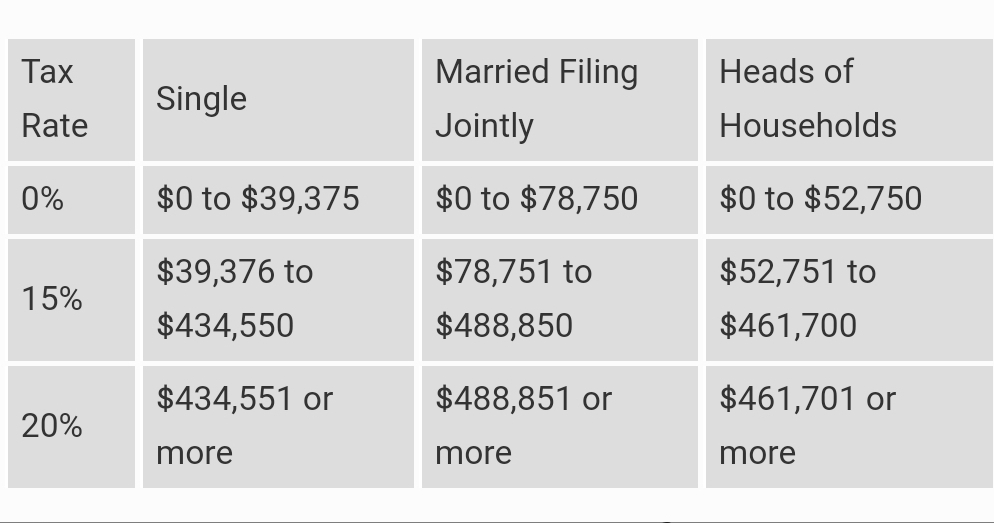

Bottom line, this year’s tax filing should be much simpler as the GOP and of course President Donald Trump pledged, but don’t expect to be jumping off your feet compared to previous years when you see your refund numbers or worst how much you’ll be owing Uncle Sam. That’s of course unless you are a corporation or an income earner that does benefit from some the more favorable changes. Such as a reduction on capital gains tax. The capital gains tax has been simplified to 3 rates ranging from 0% to 20%. The three rates are shown on the table on featured image this article.

COMMENTS