San Juan, Puerto Rico – Many news outlets began to prematurely celebrate that the Financial Oversight and Management Board (FOMB) appointed by the U.S. Federal government to manage Puerto Rico’s debt problems has come up with a new tentative agreement with bond holders. Many media outlets have focus on the numbers as highlighted by the public press releases by the Fiscal Board and the apparent savings they claim.

But as many already know, the devil is in the details. Unfortunately, the press release juggles words almost as good as the numbers.

This latest negotiation is part of a series of negotiations that has promised to reduce Puerto Rico’s debt burden and return it to the financial markets to qualify to borrow more and make more debt. While the first notion and mission of the FOMB is a problem on its own, there are more devious and less obvious consequences behind these negotiations. In fact, the negotiations are quite scrupulous in nature.

According Natalie Jaresko, executive director of the FOMB, “I’m hopeful that people over time will understand this is likely to be the most fair and confirmable resolution to exit bankruptcy.” But this is actually very far from the truth. In fact, Ms. Jaresko lied to the public about the terms of the previous deal, and is now being far more creative in attempting to hide the truth behind the new arrangement. Natalie Jaresko previously said that there were no CAB’s (Capital Appreciation Bonds) baked into the negotiation when in fact there was. Further more, the new negotiation uses a new term call CVI (Contingent Value Instrument), which is another clever way to mask once again the real net value of the deal.

Why is it appointment to eliminate CAB’s or CVI’s from the restructuring agreement?

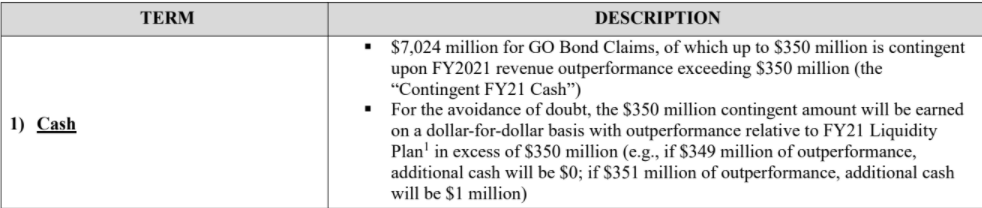

CAB’s or a CVI as perpetrated by the FOMB are instruments that mask the true cost and value of a bond typically ending in extreme and unsustainable interest yielding multipliers. Let’s take the very first line of the detail break down for the new negotiation for example:

Original Document of proposed agreement (Link contains 5 second ads)

As you can see from the description, bond holders are going to get an annual payment of $350 million plus an additional $350 million base on performance. This is essentially the same as saying that bond holders can get another 100% interest yield return on investment of the remaining principal. In a time when there are world markets with negative interest rates, and the Federal Reserve has sustain historic low rates; for a bankruptcy negotiation, this is beyond generous especially considering that the risk for these investments was the lost of up to 100% of principal.

If the 100% potential additional interest yield is not eye soring enough, the agreement also includes an initial cash payout of $7 billion. Meaning that any future savings from the deal is nearly wiped out by providing an upfront payout to bond holders.

But that is not all. In fact, the payout to bond holders is actually going to be far greater given that part of the debt includes monies owed to local suppliers and contractors to the government that will have a 99.3% reduction, or essentially will lose nearly all payments of labor, supply and services rendered. The FOMB is taking it upon themselves to once again chose between winners and losers. The Fiscal Board will make a nearly complete wealth transfer of monies owed to local businesses to increase payout to bond holders.

What concerns can considerably viewed as lacking transparency and as potentially fraudulent or intent to fraud?

First, the public press release makes the statement: “Reduces $18.8 billion of Commonwealth debt held by GO and PBA bondholders by 61%, to $7.4 billion.” While the math may seem correct, as a payout of $7.4 billion is 61% less than $18.8 billion, it doesn’t take into consideration the initial payout of the $7 billion nor does it account for the additional $3.5 billion in CVI’s. Furthermore, there is no emphasis in mentioning that local suppliers are baring the brunt of debt savings placing yet again the local economy in greater disparity. In addition, much of the initial public debt included fees, penalties and interest accumulated over time. While the agreement speaks of debt service as a holistic number, it is unclear, if not absent, on how fees to service the debt will be structured and their ultimate cost if in addition to the sums stipulated.

Also, the media release makes the statement: “Provides GO and PBA bondholders with $7.4 billion in bonds and $7 billion in cash, lifting the weight of unsustainable debt from future generations.” This statement is not completely accurate, as the inclusion of the CVI component does in fact create additional burden of debt to be paid for by future generations; at least for the next 22 years. The debt in and of itself is questionably sustainable, hence the reason for the renegotiation in the first place.

Original document for media release (link contains 5 second ads)

The second very questionable decision of the FOMB is to include payouts for $6 billion of debt which had been recognized illegally issued. The natural question for everyone should be, if certain bond holders are now going to be paid that were not in the original deal, where will the additional funds come from? It would seem that as the total payouts don’t deviate much from the original agreement, someone from the original negotiates would be willing or forcefully made to lose in this new deal. The general suspicion is in the wealth transfer from local suppliers to the bond holders, but this would be for the FOMB to clarify.

Greed and selfishness in Puerto Rico’s government

While Pedro Pierluisi and other law makers in Puerto Rico focus solely on the impact of the negotiations as it relates to public pensions, which affect their personal bottom line, they ignore the overall burden of the debt to the general population. It seems as if legislators in the island don’t see pass their own personal interests. Granted these cuts do affect other retirees, especially the elderly population, but reality is that it affects mostly those who have held high positions in government as most public workers will fall short from receiving a pension of greater than $1,500 per month.

Within the negotiation, no one in government has spoken up against the use CVI’s and/or CAB’s in debt restructuring. Arguably some may not be aware or understand these financial instruments and their potential long term impact on the economy.

Yet, Governor Pierluisi should be very understanding of these terms as he was part of earlier negotiations and has had ties in financial businesses. Furthermore, part of his selling points in his political run for governor was that he was the best candidate to negotiate favorable terms for Puerto Rico. Something that seems to have become yet another blank check of empty promises from yet another politician.

COMMENTS