Stocks dropped by the most since mid-March on Thursday following the Federal Reserve’s monetary policy decision, in which policymakers highlighted the ongoing economic concerns spurred by the coronavirus pandemic and measures taken to contain it.

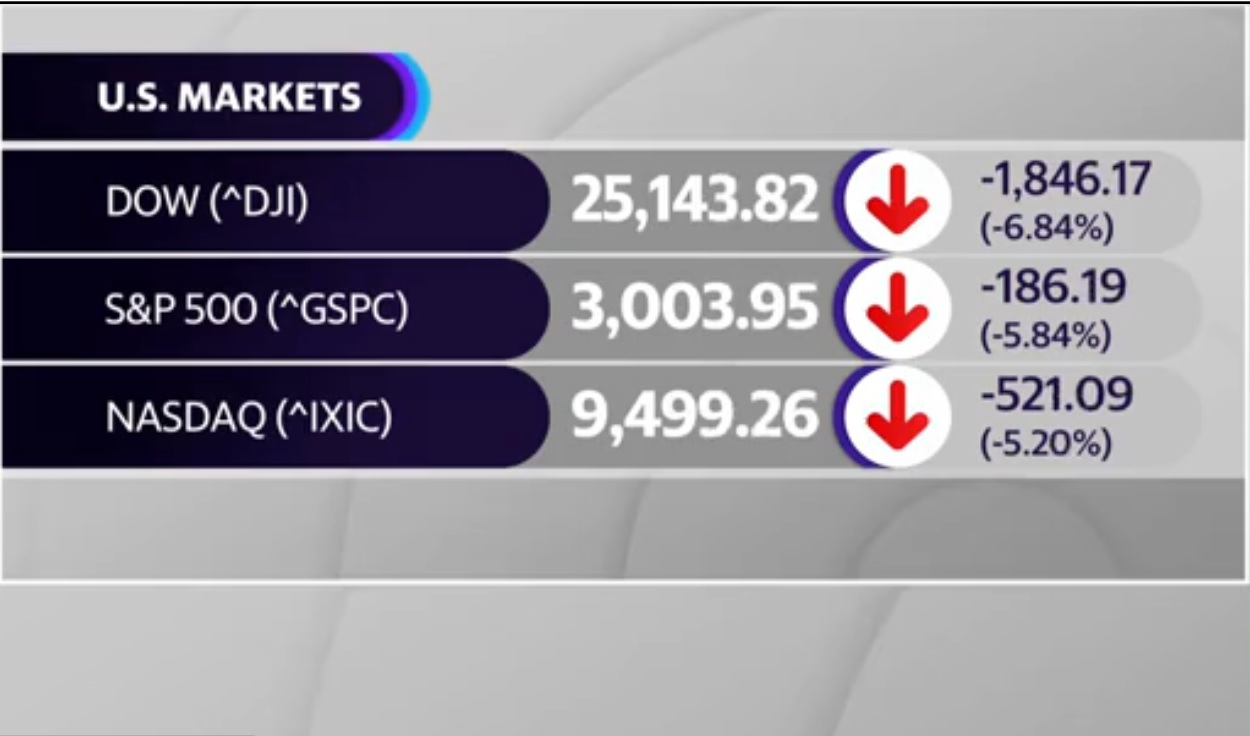

The Dow dropped 6.9%, or 1,861 points, for its worst day since March 16. The decline marked the fourth biggest point-drop for the Dow on record. The VIX Volatility Index (^VIX), or so-called fear gauge, spiked more than 50%.

“What we’re seeing here is the market taking a breather,” Alex Piré, Seeyond Head of Client Portfolio Management, told Yahoo Finance on Thursday. He cited relatively bearish remarks from Fed Chairman Jerome Powell as partly responsible for telling investors “what the market wouldn’t like to hear. But the economic news that we’re getting has stayed fairly consistent.”

Additionally, market participants eyed a rise in new coronavirus cases in key states including Arizona, Florida, North Carolina and Texas. Meanwhile, the Labor Department’s weekly report showed another 1.542 million individuals filed new unemployment insurance claims for the week ended June 6, coming down slightly from the prior week’s 1.897 million.

Shares of companies viewed as some of the most set to benefit from easing social distancing measures posted another session of steep declines. Airlines American Airlines (AAL), United Airlines (UAL) and Delta (DAL) each dropped by more than 14% Thursday. Cruise companies Carnival (CCL), Royal Caribbean (RCL) and Norwegian Cruise Line Holdings (NCLH), along with lodging firms Wynn (WYNN) and Hilton (HLT), posted their third consecutive down days.

Zoom Video Communications (ZM) was one of the few gainers, rising by about half a percent. Grubhub (GRUB) shares rose 4.7% after European food delivery platform Just Eat Takeaway announced it was set to acquire the company.

A day earlier, the Federal Open Market Committee’s (FOMC) Summary of Economic Projections indicated the Fed expects a steep 6.5% contraction in real GDP in 2020, with an unemployment rate at 9.3%. However, policymakers expect real GDP to rebound by 5.0% in 2021, with the unemployment rate dropping to 6.5%.

In its monetary policy decision, the Fed projected interest rates would remain near zero through 2022 and telegraphed that its pace of asset purchases would remain at minimum at the current rate.

The decision to keep rates on hold for the foreseeable future given the virus-induced economic damage was widely expected by market participants. And while the Fed stopped short of unveiling yield curve control strategies, as some had speculated would be the case for the central bank to put a cap on longer-term rates, Powell did suggest the FOMC would continue discussing the mechanism going forward.

“Even though [yesterday’s] FOMC meeting was somewhat of a placeholder until more meaningful choices are made in the next few meetings, the outcome was dovish nonetheless,” JPMorgan economist Michael Feroli said in a note. “The Fed kept interest rates steady and the accompanying interest rate forecast ‘dots’ indicate that rates are likely to remain pinned near zero for at least the next two-and-a-half years.

“Moreover, there was unusual unanimity in this expectation as only two participants expect any rate hikes by that time,” he added. “While the dots are individual forecasts, and not a Committee statement, the unusual lack of dispersion in those dots means it should be easier for the Committee to agree to more forceful forward guidance at upcoming meetings.”

COMMENTS