Senate Majority Leader Mitch McConnell (R-Ky.) released a massive economic stimulus bill Thursday to fight the coronavirus’s fallout, even as opposition emerged from some key Republicans to one of the central elements of the plan — direct cash payments to many Americans.

Some conservatives expressed opposition to these cash payments entirely, while others warned that GOP leaders were effectively penalizing low-income households by the way they had designed the plan.

President Trump has expressed support for the cash payment approach in recent days, but he has also shifted between numerous ideas amid waves of opposition.

Sen. Lindsey O. Graham (R-S.C.), a close ally of the president’s, was among several GOP senators voicing concern or outright opposition Thursday to the idea of direct payments, even as McConnell unveiled the trillion-dollar stimulus plan that would be the starting point for negotiations with Democrats. McConnell called for those talks to start Friday, and senators said the situation was so dire that they should not recess until they have reached a deal to pass it.

“We are facing the abyss,” said Sen. Marco Rubio (R-Fla.). “We are facing circumstances for which there is no playbook.”

A number of economists have predicted that the U.S. economy is plunging into a recession and that the unemployment rate could soar because many Americans are staying home out of fear of catching the virus. Many businesses are struggling to pay their bills and are laying off workers. The travel industry has been hit particularly hard, but more and more companies are now raising the alarm.

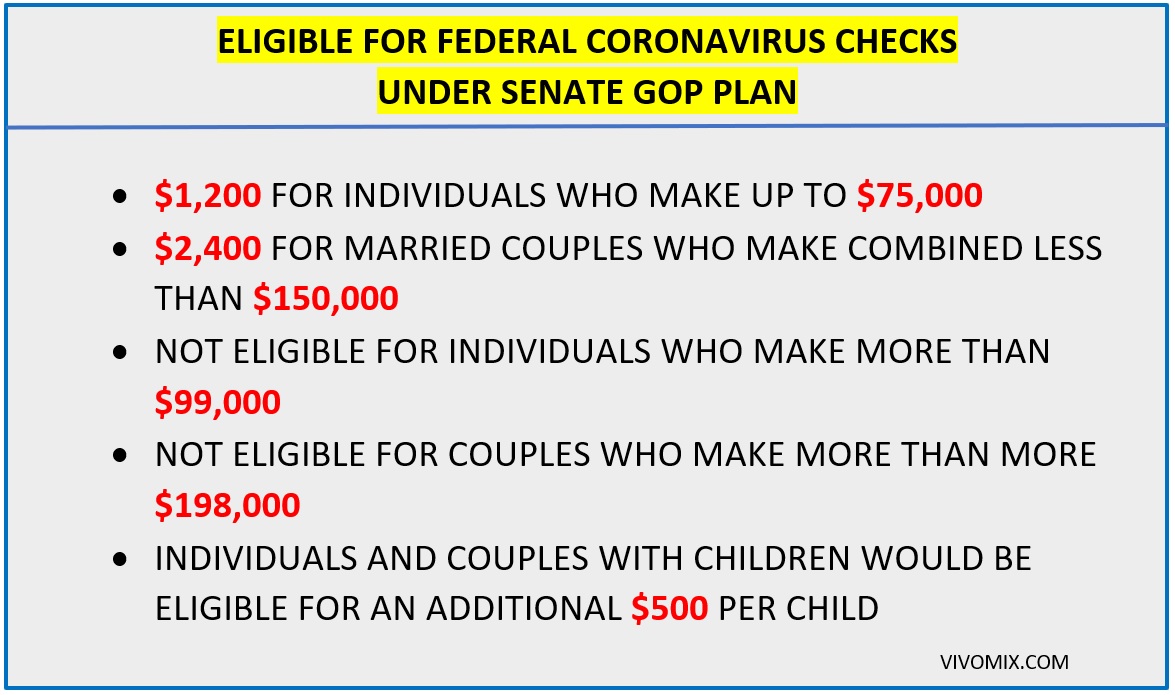

The centerpiece of the Senate GOP plan — building on a proposal revealed Wednesday by the Treasury Department — would be hundreds of billions of dollars sent to Americans in the form of checks as a way to flood the country with money in an effort to blunt the dramatic pullback of spending that has resulted from the coronavirus outbreak.

GOP proposed federal coronavirus check – vivomix news

The legislation would provide checks of $1,200 per adult for many families, as well as $500 for every child in those families. Families filing jointly would receive up to $2,400 for the adults. The size of the checks would diminish for those earning more than $75,000 and phase out completely for those earning more than $99,000. The poorest families, those with no federal income tax liability, would see smaller benefits, though the minimum would be set at $600.

Limiting the payment amount for those without federal tax liability was a change from the original White House proposal, and caught some Republicans off-guard, provoking criticism. Sen. Josh Hawley (R-Mo.) tweeted: “Relief to families in this emergency shouldn’t be regressive. Lower income families shouldn’t be penalized.”

An early analysis showed the vast majority of middle class people would receive the cash payment, but the percentage doing so falls dramatically toward the bottom of the income distribution. About 22 million people earning under $40,000 a year would see no benefit under the GOP plan, according to an initial analysis by Ernie Tedeschi, a former Obama administration economist.

The precise design of the payments had remained fluid as talks on Capitol Hill continued, with lawmakers racing to finalize the legislation. The emerging opposition to the direct payments underscored that key elements of the plan could be very much subject to change — especially since it still must be negotiated with Democrats in both chambers of Congress.

As the administration tries to get ahead of the cascading impacts of the coronavirus, Trump already shifted course once this week, abandoning for now a proposed payroll tax cut in favor of the direct payments, which he said could have a faster impact. Some of his allies, though, are not convinced.

“Direct payments make sense when an economy is beginning to restart. Makes no sense now, because it’s just money. What I want is income, not one check. I want you to get a check you count on every week, not one week,” Graham told reporters, adding that he was about to speak with newly named White House chief of staff Mark Meadows to share his views.

Senate Appropriations Committee Chairman Richard C. Shelby (R-Ala.) also voiced opposition to direct cash payments.

“I personally think that if we are going to help people, we ought to direct the cash payments maybe as a supplement to unemployment, not to the people that are still working every day,” Shelby said. “You know, just a blanket cash check to everybody in America that’s making up to $75,000, I don’t know the logic of that.”

Often, congressional leaders will try to get broad support for legislation before introducing it, but many are now rushing to complete a bill, given the growing fears about the economy’s downward trajectory.

Still, the newly voiced opposition to cash payments added to uncertainty about how quickly Congress would be able to finalize the giant stimulus plan that all parties agree is needed as the coronavirus overtakes American life and the economy. Democrats were working on their own proposals, which shun corporate loan programs being included by Republicans — such as $50 billion for airlines — suggesting that there will be difficulty in reaching bipartisan agreement.

Meanwhile the crisis is worsening. Confirmed covid-19 cases in the United States rose past 11,000 on Thursday — including two members of the House, Reps. Mario Diaz-Balart (R-Fla.) and Ben McAdams (D-Utah), bringing the crisis closer to home for lawmakers.

And the details of the big stimulus package keep changing. Trump himself embraced another idea, saying he supports having the federal government take equity stakes in private companies that receive coronavirus bailout funds.

Trump made the comment in response to a question at a briefing of his coronavirus response team, and suggested that different companies could be treated differently on the basis of past behavior. For example, Trump said that companies that have been using excess cash to buy back their stock in recent years — effectively boosting their stock prices instead of investing in new equipment — might be treated more harshly than others.

“I do, I really do,” Trump said, asked whether he would like to see the federal government take a stake in private companies. The federal government took equity stakes, effectively a type of ownership position, in certain companies that were bailed out during the financial crisis in 2008 and 2009. It’s a way of protecting taxpayer investments in firms and ensuring that taxpayers potentially benefit when a company recovers. But the approach is controversial because it essentially involves partial government ownership of private companies.

Questions about how this would work have grown in recent days as more companies and industries plead with the White House and Congress for large amounts of assistance as their operations have been disrupted in recent weeks.

“People are coming in for money. In some cases, no fault of their own,” Trump said, adding that “in some cases, where they did certain things over the course of the years, including by buying back stock, you know, they bought back stock and they paid a high price for it. … But maybe I view that as a little bit differently than somebody that didn’t and somebody that built plants all over the United States.”

The legislation McConnell released Thursday was based on what he called four “pillars” – payments to small businesses, direct cash payments to individuals, loans to industries decimated by the virus, and a surge in funding to the health-care industry.

The small-business section, which Rubio led, offers loans to small businesses with under 500 employees. The $300 billion for the loans would be made available through lenders certified by the Small Business Administration, such as banks and credit unions, with the maximum loan capped at $10 million. The portion of the loan used by the small businesses to cover their payrolls could be forgiven if firms retain their employees through the end of June 30, 2020. Loans given to firms with tipped employees, such as bars and restaurants, could be forgiven if they are used to provide additional wages to their employees.

The bill also outlines in greater detail the terms for receiving targeted federal help from the federal government, as proposed earlier by the Trump administration. The legislation includes $50 billion in “loans and loan guarantees” for passenger airlines; $8 billion for “cargo air carriers”; and $150 billion for other “eligible businesses,” a category administration officials have suggested could include the hotel and cruise industries. The legislation appears to give the Treasury Department wide authority in determining which businesses qualify for this $150 billion fund.

Democrats have demanded that any firms receiving bailout funding implement reforms such as a $15 minimum wage and an end to stock buybacks. The GOP legislation says that no “officer or employee” of a firm receiving an emergency loan can receive an increase compensation above $425,000 until after March 1, 2022.

“We’re not talking about so-called bailouts for firms that made reckless decisions,” McConnell said. “None of these firms, not corner stores, not pizza parlors, not airlines, brought this on themselves. We’re not talking about a taxpayer-funded cushion for companies that made mistakes. We’re talking about loans which must be repaid.”

Senate Minority Leader Charles E. Schumer (D-N.Y.) has offered his own plan, which skews more toward workers than corporations. And House Democrats, wary of being sidelined as the stimulus bill is negotiated between the White House and Senate Republicans, are trying to assert their power by proposing their own sweeping coronavirus economic rescue package in the coming days.

Schumer and House Speaker Nancy Pelosi (D-Calif.) said in a joint statement Thursday that Democrats were “united in our commitment” to prioritize worker and health-care concerns.

“That means taking bold action to help workers and small businesses first by greatly increasing unemployment insurance and Medicaid, making massive investments to help small businesses survive, expanding paid sick and family leave, and putting money directly into the hands of those who need it most,” they said.

On a conference calls of Democratic lawmakers Thursday, House committee chairs outlined a litany of legislative proposals — though the fine details were far from resolved and Pelosi offered no firm deadline to finalize a unified rescue plan.

On cash payments, for instance, House Ways and Means Chairman Richard E. Neal (D-Mass.) and Financial Services Committee Chairwoman Maxine Waters (D-Calif.) have outlined dueling proposals, while other Democrats have focused on beefing up existing safety net programs — such as unemployment insurance and Medicaid — as providing more targeted and effective relief.

COMMENTS